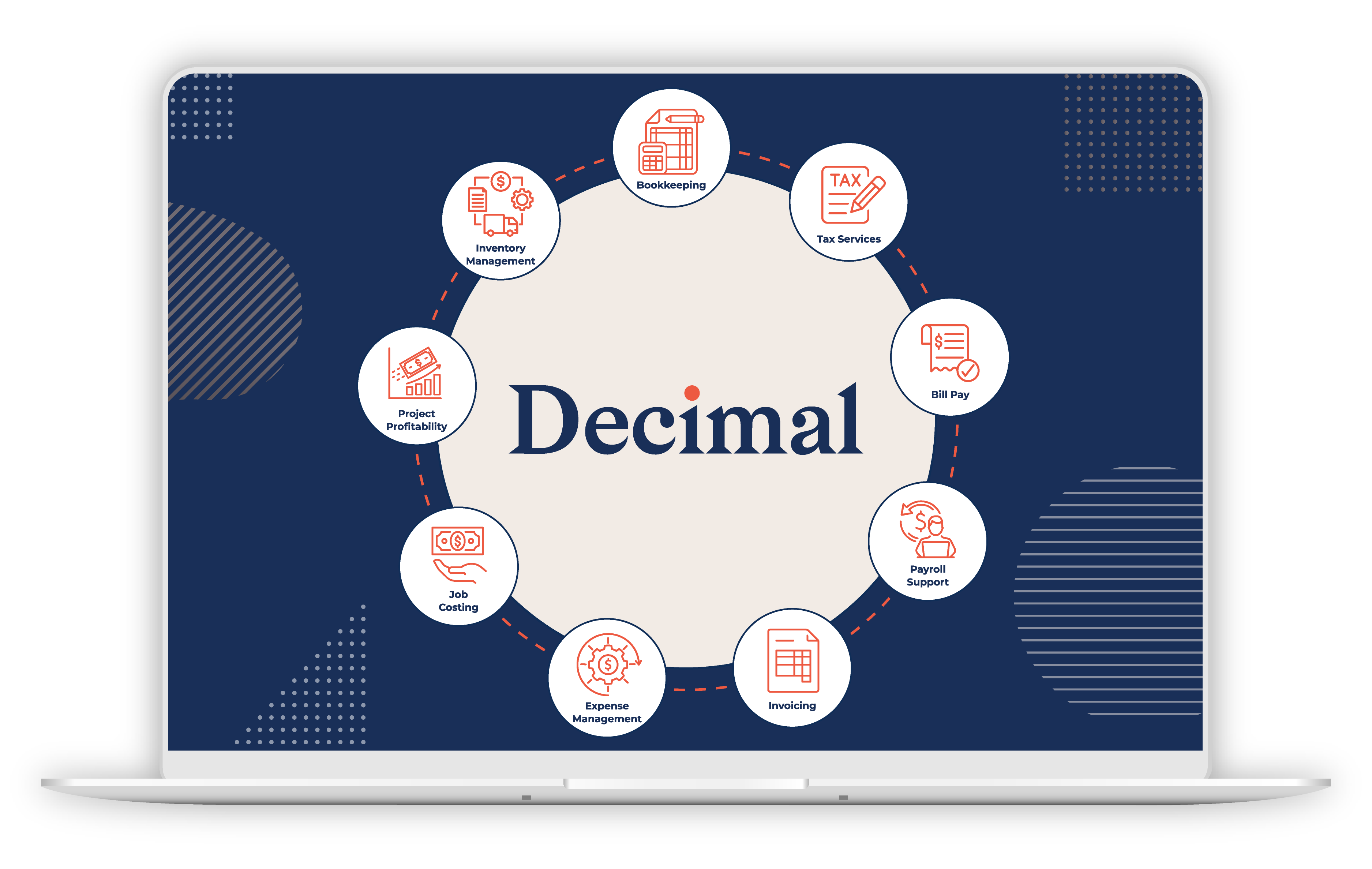

Decimal tackles financial operations for businesses: bookkeeping, bill pay, taxes, payroll, job costing, and more!

See how quality bookkeeping can be a competitive advantage.

Decimal learns how you operate, discovers the goals of your business, and understands the nuances of your industry to build the best solution. Avoid spending too much time trying to recruit the perfect accountant and work with a team of experienced professionals.

By working with our customers across all spaces, we've identified the best technology to enable your business for any scenario. Tie your operations to our recommended accounting technology & improve processes along the way through automation and outsourcing of repetitive tasks.

Discover new financial views to run your business more efficiently with accurate & actionable financial information with processes that grow with your business. Create a tax plan that doesn't leave any money on the table and capitalizes on your organized books.

There's a better way to bill. We don’t take retainers or bill you for extra hours… Decimal’s price aligns incentives and forces us to truly understand your business, improve processes, and create a competitive advantage through stronger financial operations.

See Pricing

Manual bookkeeping means wasted time, stacks of paper, endless data entry, writing checks...with Decimal there's a better way. Free up you and your employees' time for higher value work.

Decimal scales for businesses of all sizes. We keep hiring costs in high impact areas - not in the back office. Come tax time, you'll actually pay for tax prep, not cleanup.

Your Decimal team will make sure you're always on top of your business. Plus, Decimal’s Actually Fixed Pricing means you never hesitate to reach out when you have questions.

We’re here to help you manage your business in the modern world. We help you get paid, pay your bills, and track it all. No more waiting to get back to the office to keep your business moving forward.